Colorado law requires drivers to carry a minimum amount of auto insurance coverage. In general, drivers are supposed to carry proof of this coverage with them and produce it during traffic stops or when registering their vehicles. They are also required to show proof of their auto insurance coverage if or when they are involved in a car accident.

We’ve put the following guide together to help Colorado drivers understand the insurance coverage that might apply to a car accident. While we hope this is helpful, please keep in mind that it isn’t specific to your situation and doesn’t create an attorney-client relationship between with our firm.

If you are ready for legal advice specific to your situation after a car crash, please contact a Denver car accident attorney at Dormer Harpring. Our commitment to representing people from all walks of life means that we never charge for a consultation and that our legal fees are “contingent,” meaning they’re based only on the amount we recover.

The following table presents the minimum auto insurance coverage drivers are required (per Colorado law) to carry:

| Type of Coverage | Brief Explanation | Minimum Required Coverage in CO |

| Bodily Injury Liability | This covers the costs associated with injuries or fatalities to others involved in the accident if you cause the crash. | $25,000 limit (per person)

$50,000 limit (per collision) |

| Property Damage | This covers the costs of property damage (such as vehicle repairs) if you cause the crash | $15,000 limit |

So what do these numbers mean to you? Imagine you were involved in a car crash caused by another driver who only has the minimum auto insurance coverage. In this scenario, the other driver’s coverage will pay up to $25,000 to cover your injuries and up to $15,000 to cover your vehicle repair costs (plus repairs for any other property damage sustained). If there were other passengers in your vehicle who were also harmed in the collision, the minimum auto insurance coverage would then allow for up to $50,000 in total payouts to cover the injuries you and/or your passengers suffered. So if you had one passenger, each of you could be covered up to $25,000. If you had two passengers, then the total coverage available for all three persons is $50,000. With three persons, the maximum any one person could be covered is $25,000, and the maximum total for all three persons would be $50,000.

Here, it’s also important to point out that:

Aside from Bodily Injury Liability, and Property Damage coverage, there are other important coverages to consider when selecting insurance.

Other important coverages include :

Having the minimum auto insurance coverage may be enough to comply with Colorado laws, but it may will not be enough to protect drivers in many situations.

Having extra coverage like UIM and Medpay can be essential. By purchasing UIM and Medpay coverage, drivers can make sure that they are covered:

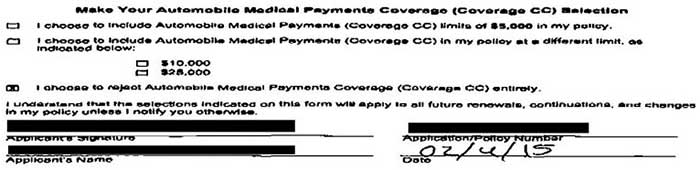

Beware rejecting MedPay like this insured did. MedPay can cover treatment for your injuries in a crash even when you cause the crash.

If you, a loved one, or a friend has been hurt in a traffic collision contact a Denver car accident attorney at Dormer Harpring for unique representation.

At Dormer Harpring, we are devoted to helping injured people, aggressively advocating for their rights, and working tirelessly to bring their cases to the best possible resolutions. Pursuing compensation is essential to paying for medical treatment, making up for the intangible difficulties of a crash and resulting injuries, and providing something in return for permanent conditions. The claims and litigation process can be confusing, lengthy, and daunting, and we have the experience to guide you through it.

To find out more about your rights, potential case, and recovery options, call us at (303) 747-4404 or email us via the contact form on this page. Our commitment to representing people from all walks of life means that:

From offices based in Denver, our attorneys provide exceptional representation to people throughout Denver County and the entire state of Colorado.

____________________________________________

Disclaimer: The content herein is only intended to be general information, not legal advice.

_____________________

References:

1: Coverage discussed herein is for noncommercial motorists. The required coverage for commercial drivers varies. More information about commercial driver coverage requirements in Colorado is available at the Colorado Division of Motor Vehicles.

2: According to a study published by the Insurance Information Institute

3: According to reports compiled by the Denver Police Department